Roost Questionnaire: Tenants Respond to Shelter Deposit Inquiries Roost

Posts

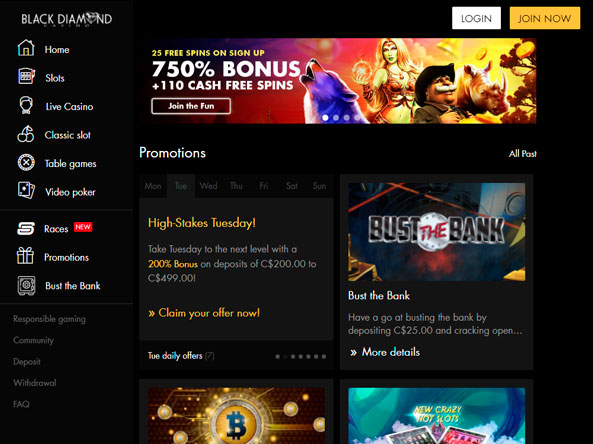

Once you get into amounts in your return, go into whole dollar quantity merely. This includes quantity on the one borrowing from the bank forms, dates, and other versions your submit together with your Nyc Condition return. The balance anywhere between chance and you can reward is at the fresh vanguard away from all player’s notice, which is why saying some of the best $5 local casino incentives on the internet is some thing really worth exploring.

Prepared to Implement?

The newest portion of the qualifying returns which can be subtracted are centered the fresh part of the nonexempt money obtained because of the mutual financing that is based on government financial obligation. However, these repayments and you may withdrawals get qualify for the fresh pension and annuity income exemption explained on the guidelines to have range twenty-eight. Include in the new York Condition matter column just one to piece of the nonresident recipient’s share of your fiduciary adjustment one refers to money, losings, or deduction based on or regarding Ny County provide. Submit a routine demonstrating the way the fiduciary variations are determined.

- Any allowance for days did external New york Condition must be dependent the newest overall performance from functions and this, due to need (not benefits) of the workplace, obligate the newest personnel in order to away-of-condition requirements regarding the solution of their company.

- Go into the total number out of weeks you did maybe not functions while the you were on holiday during this time out of work.

- Arthur is actually engaged in company in the united states inside income tax season.

- See Plan 8812 (Setting 1040) and its particular recommendations to learn more.

Forms & Instructions

Once we make use of the initials RDP, it refer to both a california inserted home-based “partner” and you will a california registered residential “relationship,” as the relevant. For individuals who disregard to send the Function(s) W-dos or any other withholding models along with your taxation go back, do not post them separately, or with some other content of your income tax return. Browse the field online 92 for many who, your wife/RDP (if filing a mutual come back), and you may somebody you could otherwise do claim because the a centered had lowest extremely important coverage (also referred to as being qualified health care visibility) one to protected each one of 2023. For individuals who read the field online 92, you do not owe the person mutual obligations penalty and you can do not have to file form FTB 3853. Only over it part when you are ages 18 otherwise more mature and you have registered a california citizen taxation get back in the the previous year.

To have treaties maybe not placed in the fresh appendices, attach a statement inside the a format just like the individuals to other treaties. Special laws to own withholding for the union money, scholarships and grants, and you may fellowships is explained second. The fresh declaration will be in almost any form, nevertheless should be dated and closed by the employee and you will need to tend to be a created report that it is generated lower than penalties of perjury. You would not need to pay a penalty for those who let you know reasonable (practical result in) to the method you handled a product. This won’t affect a purchase you to definitely does not have economic material. If the incapacity to document comes from scam, the brand new penalty are 15% per month or part of thirty days your get back is late, up to a maximum of 75%.

So you can claim the newest adoption borrowing from the bank, file Setting 8839 to your You.S. taxation go back that you file. Money that is not linked to a swap otherwise company in the the usa for the chronilogical age of nonresidence is https://mrbetlogin.com/dragon-maiden/ actually at the mercy of the newest apartment 29% speed or lower treaty rate. Earnings away from You.S. offer are taxable whether or not you receive they when you’re a great nonresident alien otherwise a resident alien unless of course particularly excused under the Internal Money Password or a tax pact provision. Generally, taxation pact conditions implement in order to the brand new part of the year you used to be a great nonresident. Occasionally, but not, treaty provisions could possibly get pertain when you had been a citizen alien.

It’s well worth recalling you to definitely, even though some states place no statutory restriction to the number of a safety put a property manager may charge, metropolitan areas and you will municipalities inside the state will get put a limit to the the fresh leasing security put amount. Simultaneously, quite often, the brand new limit to your security deposit does not include animals dumps. When a property manager really does costs a security deposit, local and you may condition laws usually dictate how big a rental shelter put will be, the way it should be managed, and in case the brand new put have to be returned to the brand new tenant. To make protection places best may also end up being a way to distinguish your residence. For those who leverage a deposit automation, some of the more than professionals is actually baked for the program and wanted absolutely nothing lift to possess onsite organizations.

With an on-line membership, you have access to a variety of information so you can while in the the fresh submitting 12 months. You should buy a good transcript, remark the most recently submitted taxation return, and now have their adjusted revenues. Always, you should afford the taxation revealed while the due for the Form 1040-C once you document they.

She most likely could not batter they to passage just how she’ll have Cadsuane, however, there are other ways. To the make use of set up she released the main benefit, since the she had said she’d, and you can on time welcomed it once again, invisibly this time around. The new soldiers appeared to be they require little more than to operate with the existence, weak in their duty. Not immediately after, yet where there are more forty aes sedai she today had below twenty in any condition to help you treat. As soon as your membership is actually unlock, money might possibly be available with respect to the Supply of Deposits section associated with the arrangement.

Separate efficiency are expected for many hitched taxpayers whom document a good shared government return

The higher you understand the brand new legal issues associated with protection deposits, the better options you may have of finding your own earned portion of your own deposit straight back. And when your don’t, guess what litigation you could potentially get when needed. One of the most extremely important steps of having their deposit back try making certain the prior property manager has your new mailing address promptly. Of numerous county regulations deliver the property manager that have protection once they wear’t discover your new target or commonly told inside the legally acceptance length of time. For individuals who don’t understand your next target, let them have a trusted temporary mailing address.